Why every industrial

company needs a

Capex Council

You can tell a lot about a company by how it allocates capital.

For example: Is it outperforming its peers? Can it pivot quickly when business conditions change? Does it proactively manage its largest investments to optimize returns?

For capital-intensive businesses, the answers to these questions often come down to one thing: whether or not they’re effective at managing their capital investments. And one indicator of that is if they have a Capex Council.

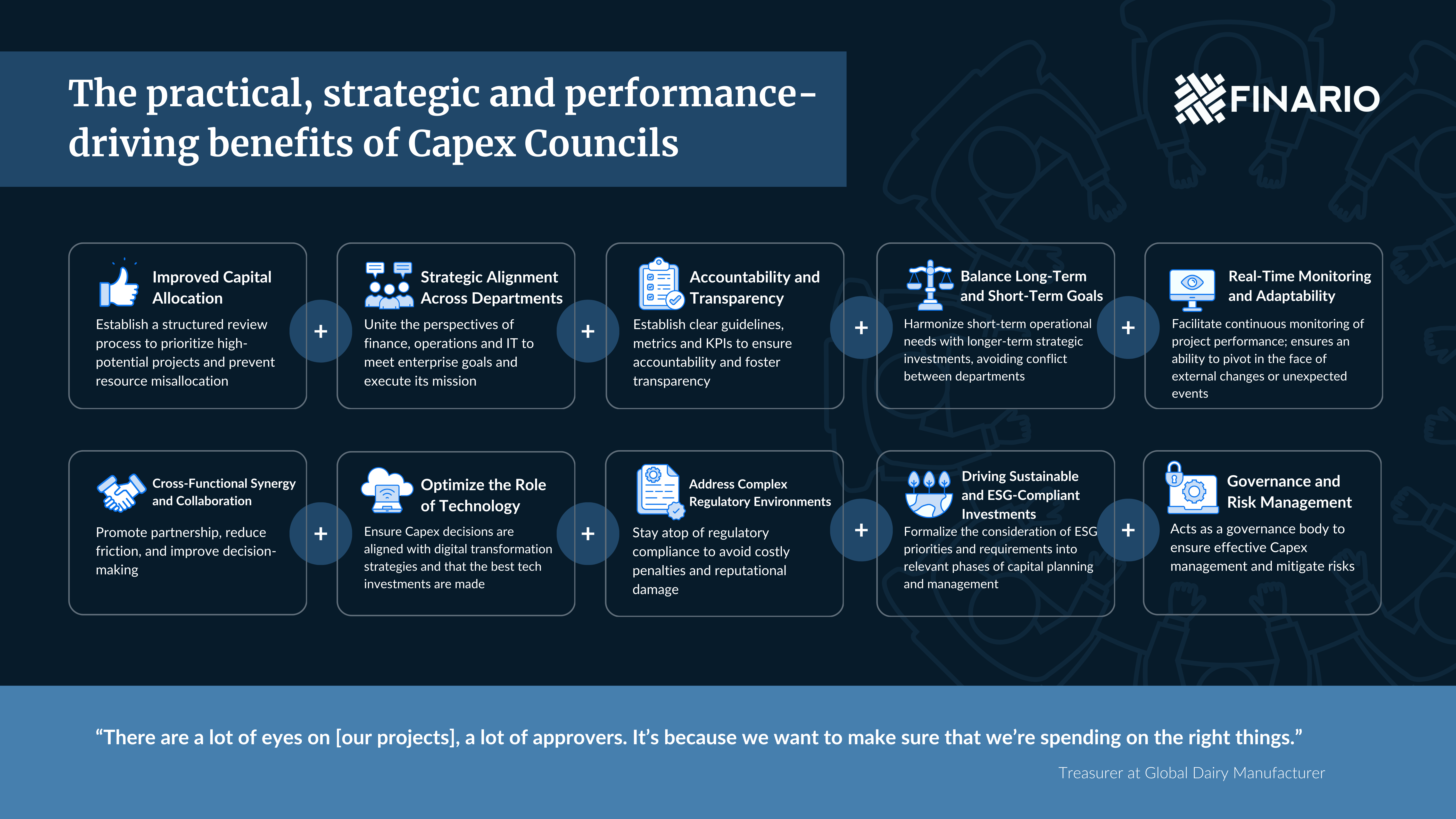

A Capex Council brings clarity, structure, and collaboration to the capital allocation process, ensuring that funding balances immediate needs and long-term goals.

So what is a Capex Council?

Think of a Capex Council as a Board of Directors for your capital investment portfolio. It’s a cross-functional team, typically comprising leaders from finance, operations, IT, and procurement, with one overarching mandate: align capital allocation decisions with high-level strategic objectives.

Its responsibilities include:

- Reviewing proposed and ongoing projects to ensure they’re still viable and on track.

- Reallocating resources when new opportunities arise or priorities shift.

- Championing transformative initiatives and ensuring they secure the attention they deserve at senior levels.

This is about rigor, not red tape. Much like a board provides oversight for corporate strategy, a Capex Council does so for a company’s largest investments.

Why do you need one?

Few line items are as pivotal to the long-term health of a capital-intensive company as its Capex portfolio. McKinsey predicts that we’re undergoing “a once-in-a-lifetime wave of capital spending on physical assets between now and 2027,” amounting to “about $130 trillion.” With so much at stake, ensuring that these investments deliver strong returns and further company goals is critical to success.

Unfortunately, a number of barriers can keep organizations from maximizing the value of these all-important investments.

Departmental silos

Your colleagues in finance, operations, and IT could sit just feet away, but when it comes to aligning on Capex priorities, it might feel like they’re oceans apart. Each department can have its own priorities, its own data, its own way of doing things…all of which leads to fragmentation that stymies growth and efficiency.

Take, for example, Schreiber Foods – a global manufacturer of cream cheese, natural cheese, process cheese, beverage and yogurt products with annual sales exceeding $7 billion. Prior to the formation of their Capex Council, departmental silos were a major pain point in their capital allocation process, with projects being prioritized on a first-come, first-served basis, rather than them being evaluated based on merit. “We’d end up with [a situation where] whoever was first got the money,” said James Grant, Assistant Treasurer.

Now, Schreiber has “a more thoughtful allocation of spending.” Rather than doling out funds based on project readiness, they carefully weigh the trade-offs between projects and prioritize funding the highest-impact opportunities.

The challenges were similar at La-Z-Boy Incorporated, one of the largest furniture companies in the United States. High-priority projects could fall behind schedule, causing a ripple effect that resulted in underspending. Once their Capex Council was in place, project forecasts received “a lot more scrutiny,” explained Chris McKenzie, Director of Manufacturing Engineering. “Are we having a gap or a trend develop? And if so, do we need to react to it? These are the kinds of questions that our Council has helped us answer.”

A lack of visibility

A Capex Council also gives the right stakeholders the right project visibility at the right time. For Altium Packaging – a leading manufacturer and supplier of customized packaging solutions for a diverse range of industries – this begins with a formal intake process. “The main job of the Council is to compare one project to others in the portfolio,” said PMO Leader Jim Rees. If a project aligns with their organization’s strategic objectives, the Council greenlights further development. If not, it’s scrapped before too much time and effort is poured into it. Doing so frees up time and capital for projects that can really move the needle.

Schreiber’s project visibility issues extended to the C-suite. Without a formalized approval process, project proposals frequently bypassed necessary scrutiny and landed directly on the CEO’s desk – resulting in meetings that got bogged down in discussions better suited for lower-level review.

The introduction of a Capex Council brought much-needed structure to the process. Schreiber now holds regular Council meetings every two to three weeks, allowing stakeholders to review projects, address emerging trends, and reallocate funds as necessary. Now, by the time they reach senior leadership, these expenditures have already been thoroughly vetted.

How is a Capex Council structured?

There is no one-size-fits all design for a Capex Council. That being said, certain principles like diverse representation are universal. La-Z-Boy’s Council, for instance, includes 10 to 12 vice presidents from engineering, safety, procurement, R&D, and logistics. Other organizations may opt for a smaller group or include different functions like IT. What matters most is assembling a diverse cross-section of leaders committed to advancing the organization’s strategic objectives with a clear line of communication, collaboration, and common frames of reference.

The room where it happens

Capex Council meetings typically focus on two main objectives: optimizing current resource allocation and preparing for future opportunities and challenges. Take Schreiber Foods: their Council meets every two to three weeks with a two-part agenda that facilitates a holistic approach to capital planning.

- Part 1: Project-level review: Projects exceeding the Council’s approval threshold are presented with relevant data. The project champion kicks off the discussion with a high-level summary, followed by an open debate among other members. “Sometimes it’s quick, sometimes it’s 30 minutes on one project,” Grant explained.

- Part 2: Big-picture forecasting: Once individual projects are addressed, the focus shifts to the future. Schreiber’s Council looks at total spending projections for the next two to five years, discussing unplanned needs, adjustments to project timelines, or board-level readiness for upcoming initiatives.

Reallocating resources

Flexibility in resource allocation is one of the most significant advantages of having a Capex Council. It means that high-priority projects can receive funding even when priorities shift mid-stream.

La-Z-Boy’s Council introduced a formal process for reviewing “break-in projects” — that is, critical but unplanned initiatives that require additional funding. “If you planned for something at $250,000, and it actually came in at $325,000, we can decide if that additional funding is warranted,” said McKenzie. This system allows La-Z-Boy to address urgent needs, such as machinery failures or emerging opportunities, without jeopardizing other investments.

Intake and prioritization

Not every project idea warrants a full funding review by the Council. That’s why organizations like Altium Packaging use a rigorous intake process to evaluate potential initiatives early on. If an idea seems promising, Rees says they’ll tell the project leader to “go invest the time and effort it takes to create the business case.” But if it doesn’t align with the company’s strategic priorities, it’s tabled early in the process, preventing wasted time and resources.

Where the rubber meets the road

Every company says they want their Capex portfolio to deliver competitive returns while furthering their strategic goals. But executing on that mission requires a senior-level mandate and cross-functional collaboration.

That’s the idea behind a Capex Council. Though structurally and conceptually smart, however, it can only be as effective as the tools it has at its disposal to make the best decisions at the best times. Finario provides the visibility and analytics that enable organizations to make those decisions with precision and confidence. It’s why Schreiber, Lay-Z-Boy, and Altium use Finario during their Council meetings to drill into project details on the spot, allowing stakeholders to evaluate trade-offs and make informed choices based on real-time data insights.

A well-structured Capex Council will clear the way for your most promising projects to get the funding (and focus) they deserve.

Shuffle the deck and spark a conversation that leads to Capex success.

The first step to establishing a Capex Council is to engage and align your cross-functional team to really understand the strengths and weaknesses in how you are choosing and managing your capital investments.

To achieve this, use our Capex Conversation Starter Cards to help get the conversation going and foster true collaboration and a roadmap for success.